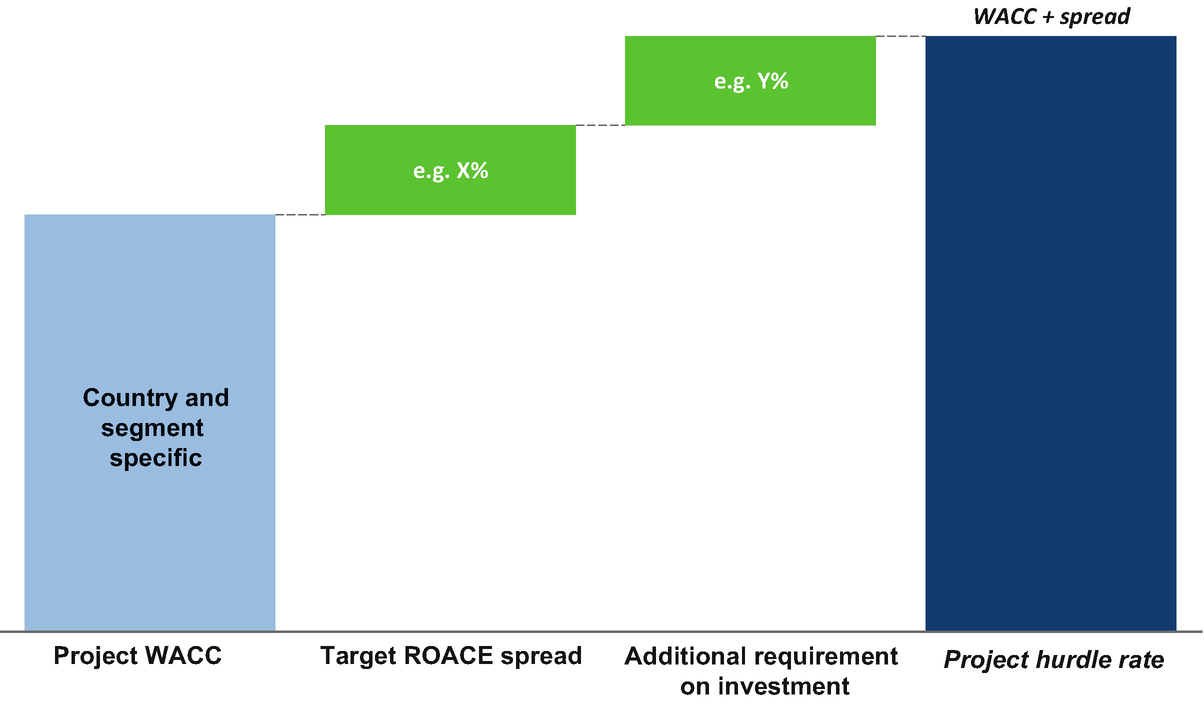

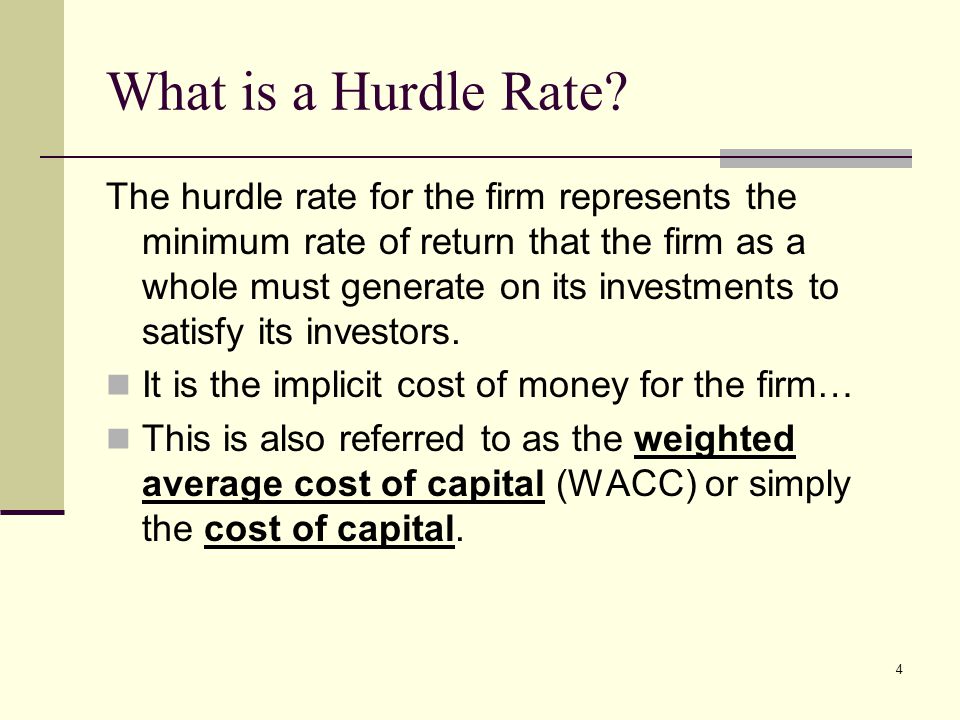

Hurdle rate WACC risk premium to account for the risk associated with a projects cash flows. This calculates the firms hurdle rate.

/sum-offset-formula-excel-56a8f81f3df78cf772a251d0.gif)

Calculate Irr Formula With Excel With Screenshots

The hedge fund managers also charge an incentive fee of 20 of profits.

Hurdle rate formula. The basic hurdle rate formula is straightforward. A simple representation of the hurdle rate is as follows. How to Calculate Hurdle Rate in Excel Example.

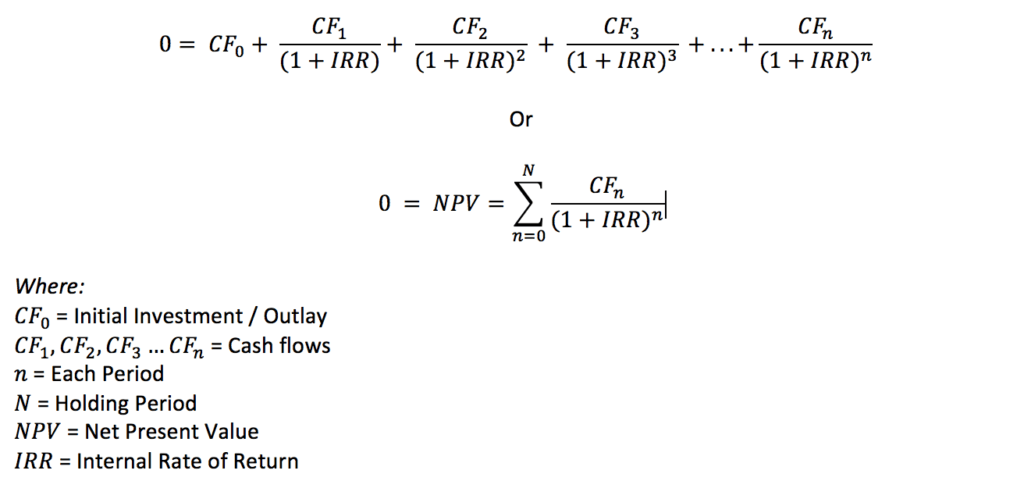

If a business plans to invest in a new piece of equipment costing 20000 and expects to save 5000 a year for the next 5 years then the internal rate of return of the project is given by the Excel RATE function as follows. A minimum acceptable rate of return on a project. Hurdle rates typically favor projects or investments that have high rates of return on a percentage basis even if the dollar value is smaller.

Topics referred to by the same term. This is paid irrespective of how the fund performs. Since financial resources are finite there is a hurdle that projects have to cross before being deemed acceptable.

The fee charged is mentioned as 2 and 20 which means. In a hedge fund the investors pay two types of fee to the hedge fund managers namely management fee and incentive fee also called performance fees. The rate is determined by assessing the cost of capital Unlevered Cost of Capital Unlevered cost of capital is the theoretical cost of a company financing itself for implementation of a capital project assuming no.

For example project A has a return of 20 and a. Hence the hurdle rate of the company is 139 10913. Limitations of the hurdle rate.

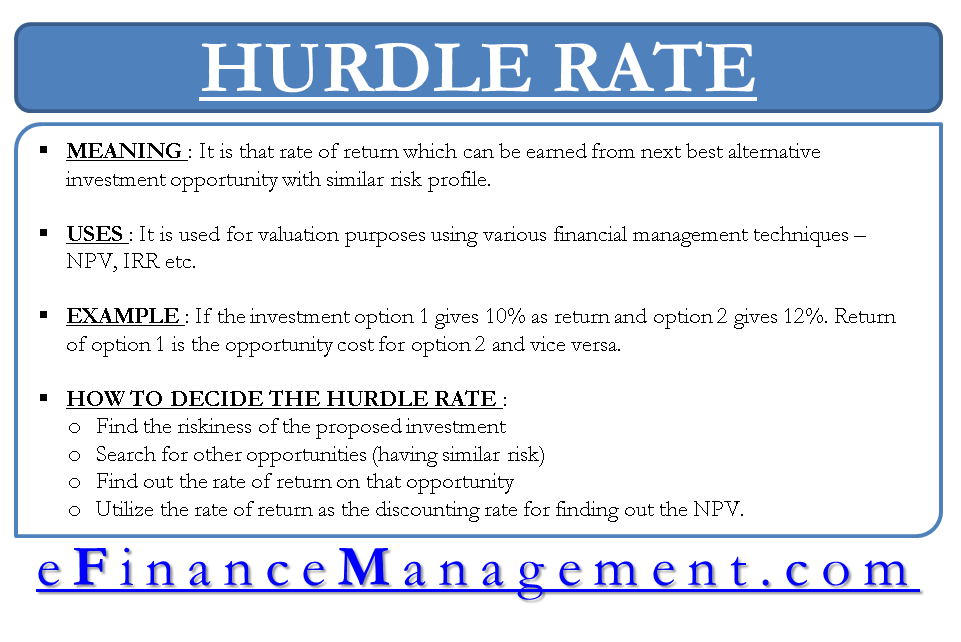

Generally the hurdle rate is equal to the companys costs of capital which is a combination of the cost of equity and the cost of debt. Continuing with the example Excel uses the required rate of return on equity from cell B1 and the values in cells A4 through A7 to. A hurdle rate which is also known as minimum acceptable rate of return MARR is the minimum required rate of return or target rate that investors are expecting to receive on an investment.

For example if an investors cost of capital is 5 and the risk premium for a. This disambiguation page lists articles associated with the title Hurdle rate. Compute the weighted average cost of capital Hurdle Rate when considering an investment.

They typically charge a management fee of 1-2 of funds net asset value. Calculating Hurdle Rate. This hurdle will be higher for riskier projects than for safer projects.

Internal rate of return RATE55000-20000 Internal rate of return 793. The rate is determined by assessing the cost of capital risks involved current opportunities in business expansion rates of return for similar investments and other. Since its a cost rate we shall add a risk premium in the cost of capital to get the hurdle rate.

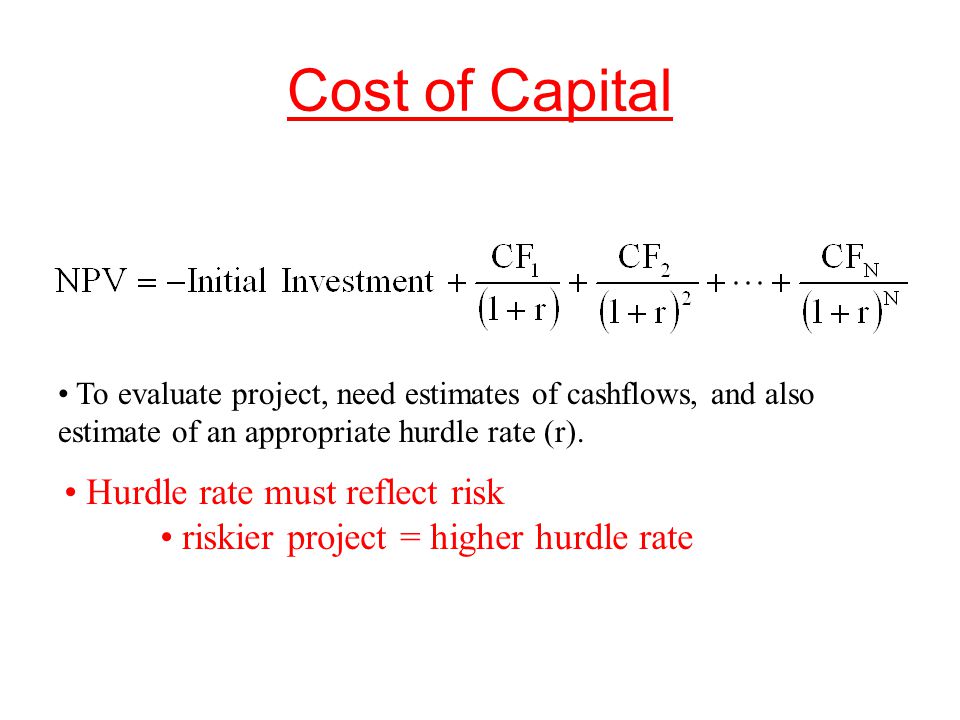

Type the WACC formula B1_A5A4A5A7_1-A6A4A4A5 and press Enter. Cost of capital risk premium hurdle rate. Hurdle rate is the minimum acceptable return on a project that a firm requires given its risk profile and opportunity cost of other investments At a broad level there are 3 approaches adopted by firms to measure hurdle rates.

Hurdle rate may refer to. Thumb Rules Firm WACC Build Up Project WACC Firm WACC 3-5 Premium 5 Year Stock Index average returns SENSEX in India. Hurdle Rate Hurdle Rate Definition A hurdle rate which is also known as minimum acceptable rate of return MARR is the minimum required rate of return or target rate that investors are expecting to receive on an investment.

Hurdle rate Riskless Rate Risk Premium. Here is the formula. The standard formula for calculating a hurdle rate is to calculate the cost of raising money known as the Weighted Average Cost of Capital WACC then adjust this for the projects risk premium.

A level of return that a hedge fund must exceed before it can charge a performance fee. To calculate hurdle rate an investor starts with the cost of capital and adds the risk premium that is necessary to adjust for the possibility that the investment will not be successful. Heres the formula for calculating a hurdle rate.

Understanding The Weighted Average Cost Of Capital Wacc By Dobromir Dikov Fcca Magnimetrics Medium

Risk Measurement And Hurdle Rates In Practice Ppt Download

Lp Corner Fund Terms Carried Interest Preferred Return And Gp Catchup Allen Latta S Thoughts On Private Equity Etc

How To Win The Hurdle Rate Test For Funding Approval In 6 Steps

Hurdle Rate Calculation Plan Projections

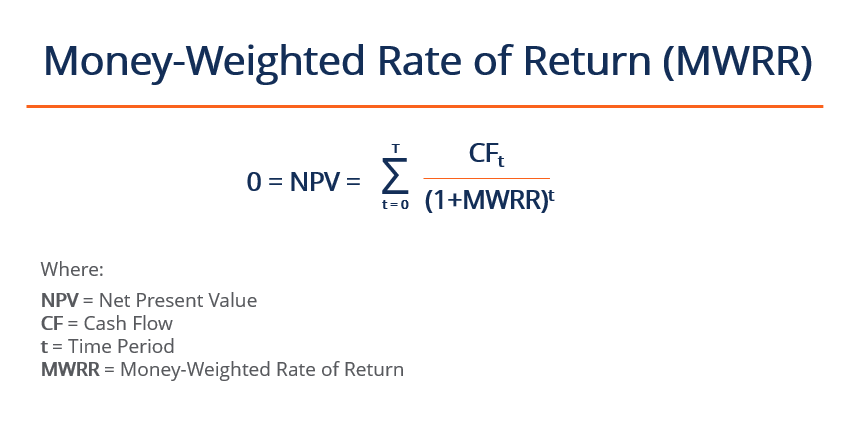

Money Weighted Rate Of Return Mwrr Overview Formula Example

Conflict Between Npv And Irr India Dictionary

Internal Rate Of Return Irr A Guide For Financial Analysts

Waccs And Hurdle Rate Springerlink

Opportunity Cost Of Capital Hurdle Rate Discounting Rate In Net Present Value Evaluation

Hurdle Rate Calculator Irr Calculation

Investing In Software Intp Blog

Difference Hurdal Price Wacc And Low Cost Price India Dictionary

Business Case For Green Design Facilities Management Insights

Post a Comment

Post a Comment