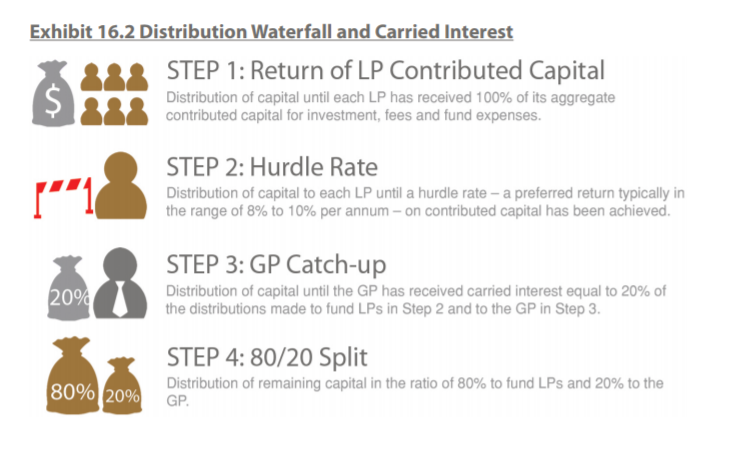

Some funds such as fund-of-funds use a multiple of contributed capital as the preferred return hurdle instead of an annualized percentage rate. The rate is determined by assessing the cost of capital.

Hedge Fund Fee Structure Prepnuggets

This is paid irrespective of how the fund performs.

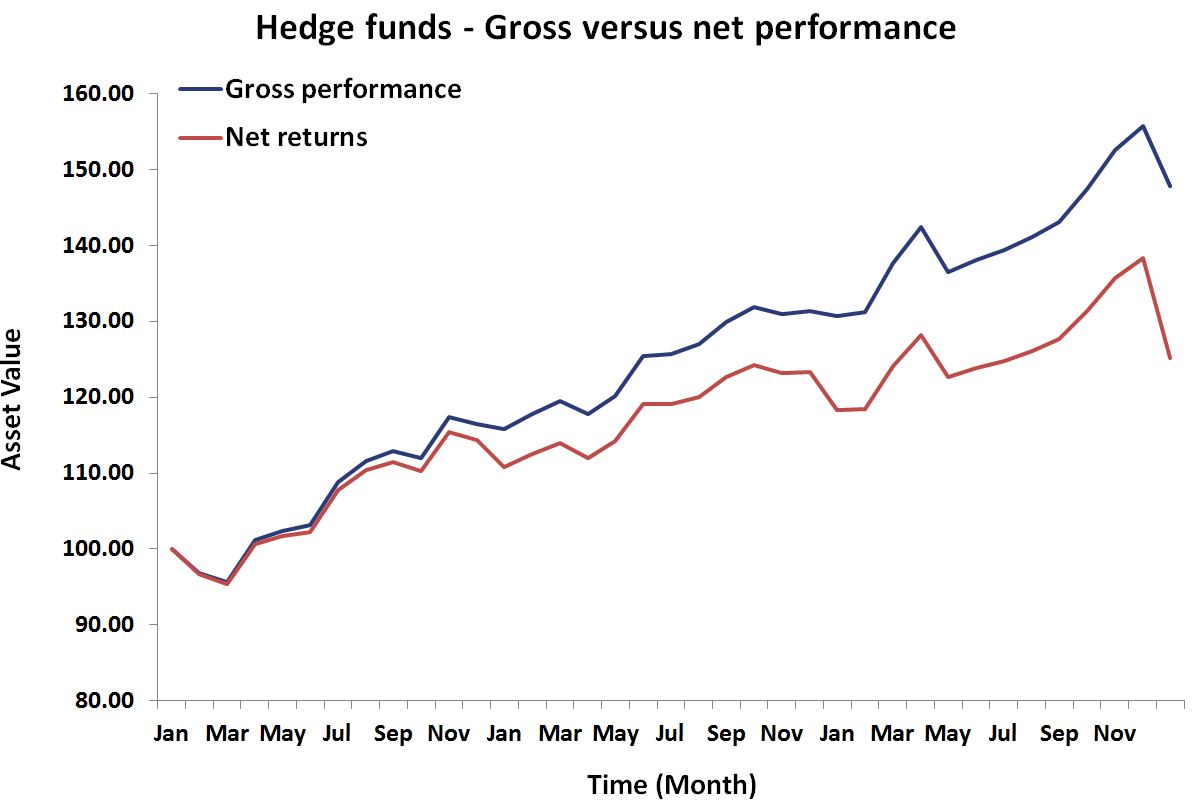

Hurdle rate funds. Once the preferred return hurdle is met and the GP starts taking carry it is customary for the GP to receive most if not. The hedge fund managers also charge an incentive fee of 20 of profits. If a 1 million fund has a 10 hurdle rate which would be very high it must return 11 million after one year or 2 to 26 million after 10 years depending on the compounding formula before the managers performance compensation kicks in.

Below this any returns on its investments will accrue only to. One of the most important factors that will go into this calculation is life expectancy. Ad No Dealing Charge On A Range Of Lower Cost Funds.

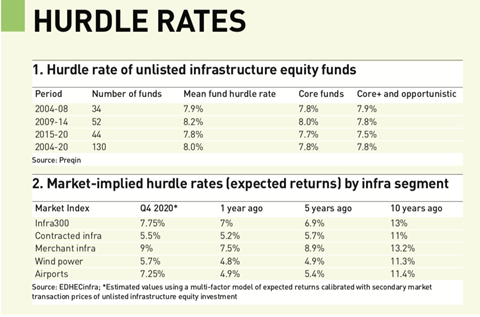

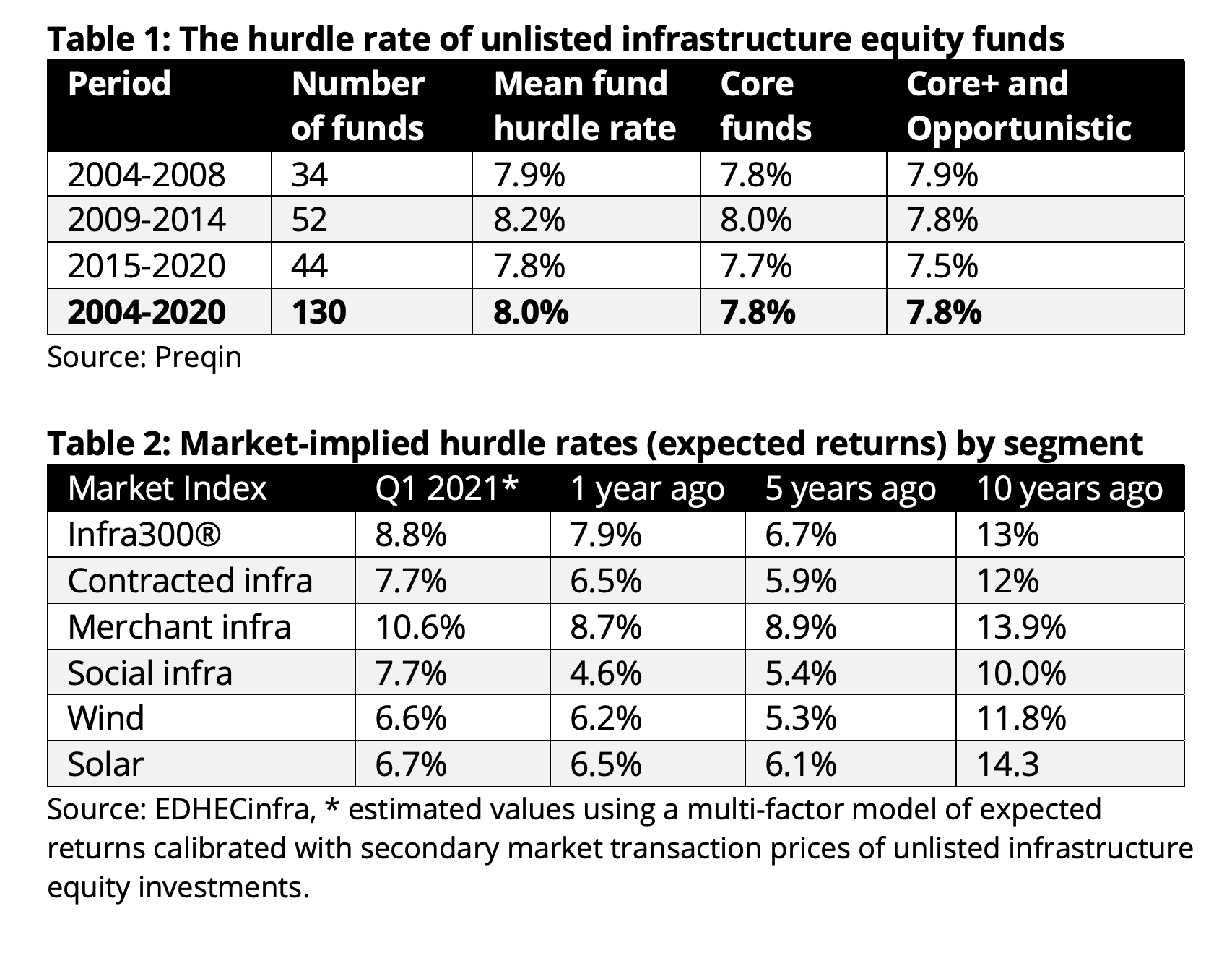

Unlevered Cost of Capital Unlevered cost of capital is the theoretical cost of a company financing itself for implementation of a capital project assuming no. Hurdle rates are becoming less common and more modest. A typical private equity fund has a hurdle rate usually a 7-8 return on its investment says Montgomery.

This rate is usually a benchmark interest rate such as Libor or the one-year T-rate plus a fixed spread. Are You Invested With The Best Fund Managers. We Can Refer you to a Local Regulated Company for a No Obligation Consultation.

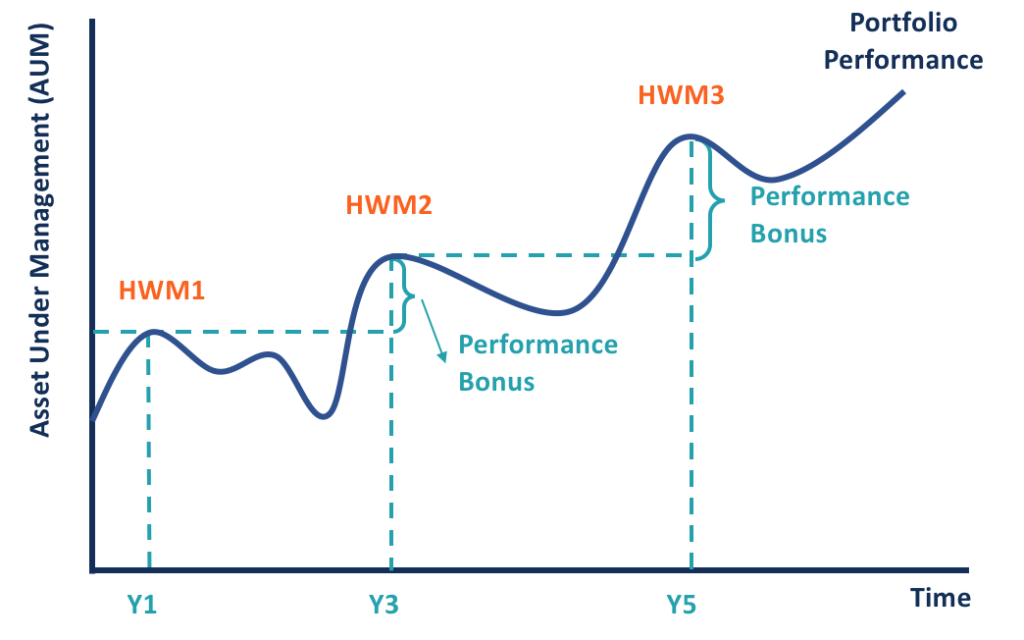

Ad Looking to Maximise your Retirement Fund with an Annuity. Meeting the hurdle or preferred return typically means that those involved in managing the fund share 20 profits above a hurdle rate equivalent to an annualised rate of. When closing a fund the general partners GPs agree with their limited partners LPs on a hurdle ratea minimum return above which GPs will receive a share of profits.

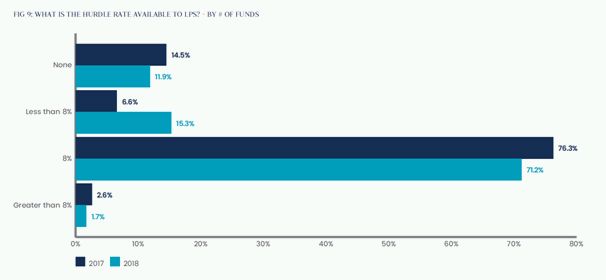

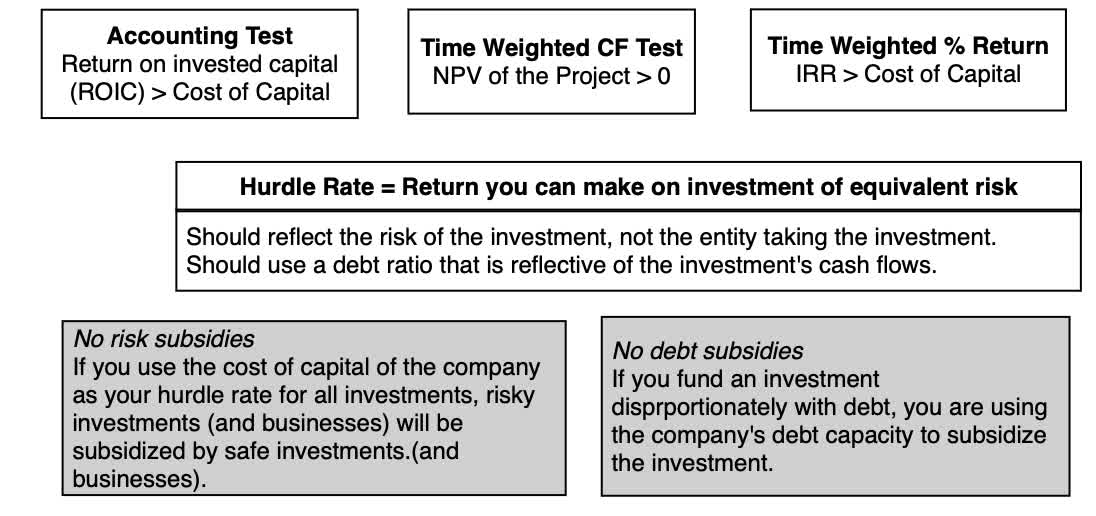

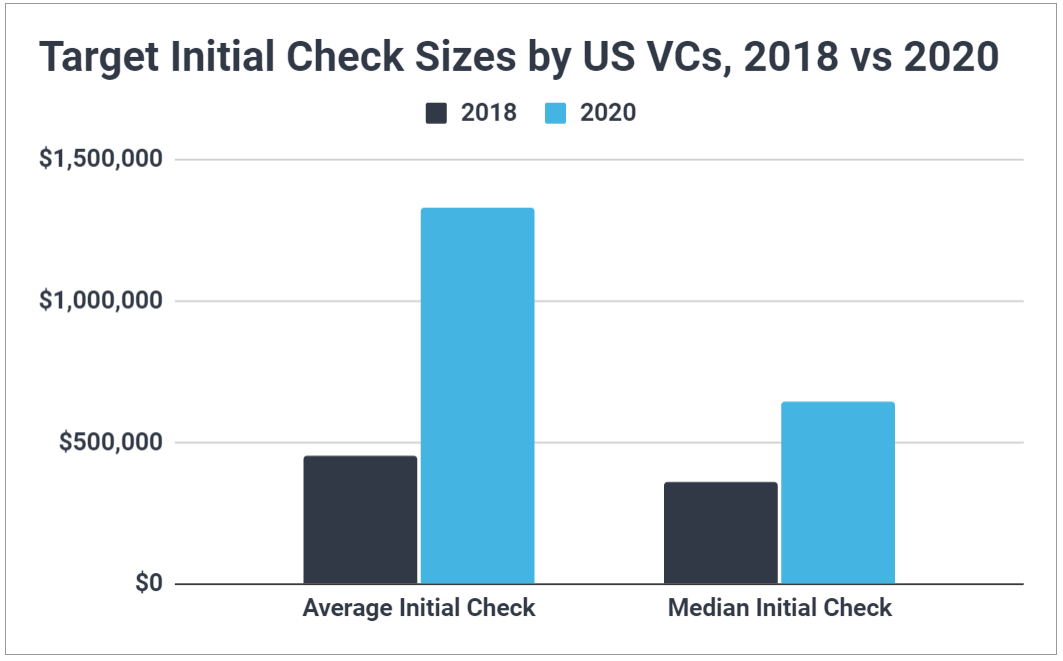

Hurdle rate is the minimum acceptable return on a project that a firm requires given its risk profile and opportunity cost of other investments At a broad level there are 3 approaches adopted by firms to measure hurdle rates. They typically charge a management fee of 1-2 of funds net asset value. Since 2018 we have seen not only a reduction in the number of funds that set hurdle rates down to 15 but also the rate of the hurdle.

Thumb Rules Firm WACC Build Up Project WACC Firm WACC 3-5 Premium 5 Year Stock Index average returns SENSEX in India. In this case the GP doesnt take carry until the LPs have received for example 2x of their contributed capital. Forty percent of funds with 5 billion in assets or less used hurdle rates while only 20 percent of large funds with assets of more than 5 billion.

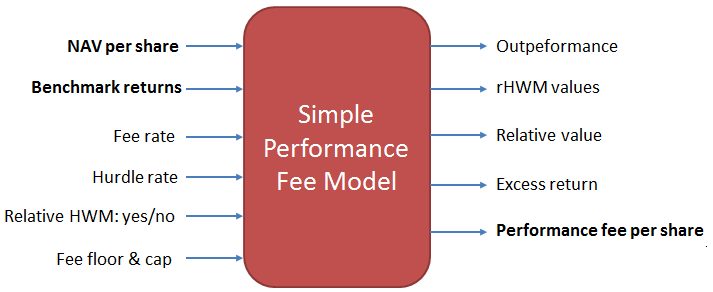

In a hedge fund the investors pay two types of fee to the hedge fund managers namely management fee and incentive fee also called performance fees. We Can Refer you to a Local Regulated Company for a No Obligation Consultation. In effect hurdle rates.

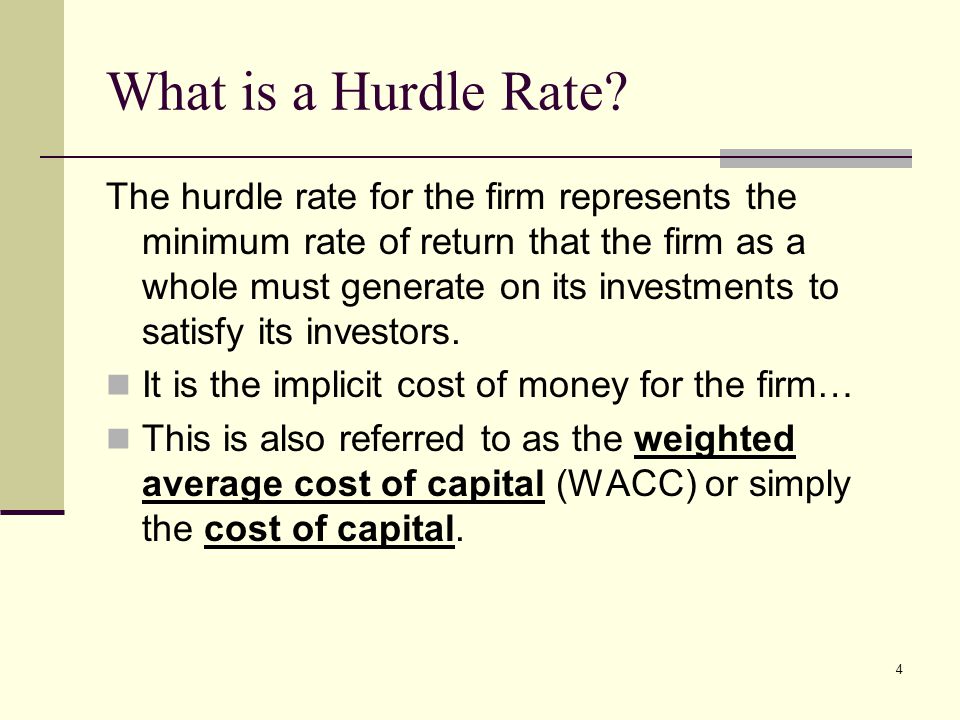

GP Priority in Catchup. A hurdle rate is a yearly percentage return used to calculate the hurdle amount. The hurdle rate is the minimum rate of return that the hedge fund manager should generate before he or she can charge a performance fee.

Whereas the average hurdle rate from our 2018 report was 725 we now find the average is 585. And whereas the median hurdle rate from 2018 was 8 its now 6. Ad Download Free Fund Manager League Table Report And Identify Top Fund Managers.

To keep things simple the hurdle rate also known as the internal rate of return is essentially the rate of return necessary for the investment of the lump-sum option to produce the same income as the fixed monthly payment option. Hurdle rates are more common at small funds. Ad Looking to Maximise your Retirement Fund with an Annuity.

A hurdle rate which is also known as minimum acceptable rate of return MARR is the minimum required rate of return or target rate that investors are expecting to receive on an investment. The fee charged is mentioned as 2 and 20 which means 2 management fee and 20 of funds.

High Hurdle Rates Not Good For Investors In Infrastructure Funds Financial Times Partner Content By Edhecinfra

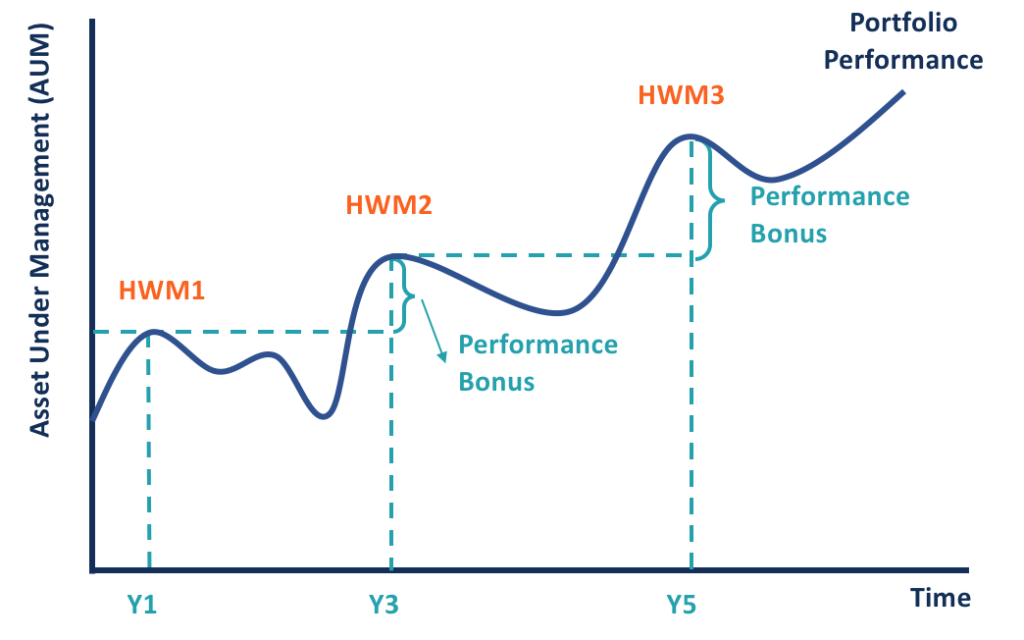

High Water Mark Overview How It Works Examples

Pe Waterfall Modelling Catch Up Wall Street Oasis

Is Hurdle Rate The Right Option For Your Fund Wipfli

Hurdle Rates And Investment Decisions Investing For Productivity And Prosperity The National Academies Press

Hurdle Rates A Ticking Timebomb Magazine Real Assets

Simple Performance Fee Calculation For Investment Funds Software Tuncalik Com

/GettyImages-936532610-7ac0645e2de14a16b3f0155b5badee91.jpg)

High Water Mark Vs Hurdle Rate What S The Difference

Lp Corner Fund Terms Carried Interest Preferred Return And Gp Catchup Allen Latta S Thoughts On Private Equity Etc

Hedge Fund Fee Structure Breaking Down Finance

Private Equity Fund Terms Research Core Economic Terms Hurdle Rate And Carried Interest Corporate Commercial Law Uk

How To Win The Hurdle Rate Test For Funding Approval In 6 Steps

Data Update 4 For 2021 The Hurdle Rate Question Seeking Alpha

High Hurdle Rates Not Good For Investors In Infrastructure Funds Financial Times Partner Content By Edhecinfra

Difference Hurdal Price Wacc And Low Cost Price India Dictionary

How To Win The Hurdle Rate Test For Funding Approval In 6 Steps

Post a Comment

Post a Comment