A preferred return or hurdle rate is a minimum threshold return that LPs must receive before the GP can receive its carried interest or carry. Ad Access vetted investments in exciting startups if your annual income exceeds 100k.

Carried Interest Guide For Private Equity Professionals

Its a benchmark investors private equity firms and management teams use to evaluate potential opportunities.

Hurdle rate private equity. A hurdle rate which is also known as minimum acceptable rate of return MARR is the minimum required rate of return or target rate that investors are expecting to receive on an investment. OurCrowd provides an early investing opportunity to vetted tech startups alongside VCs. Find information on every aspect of the global PE ecosystem.

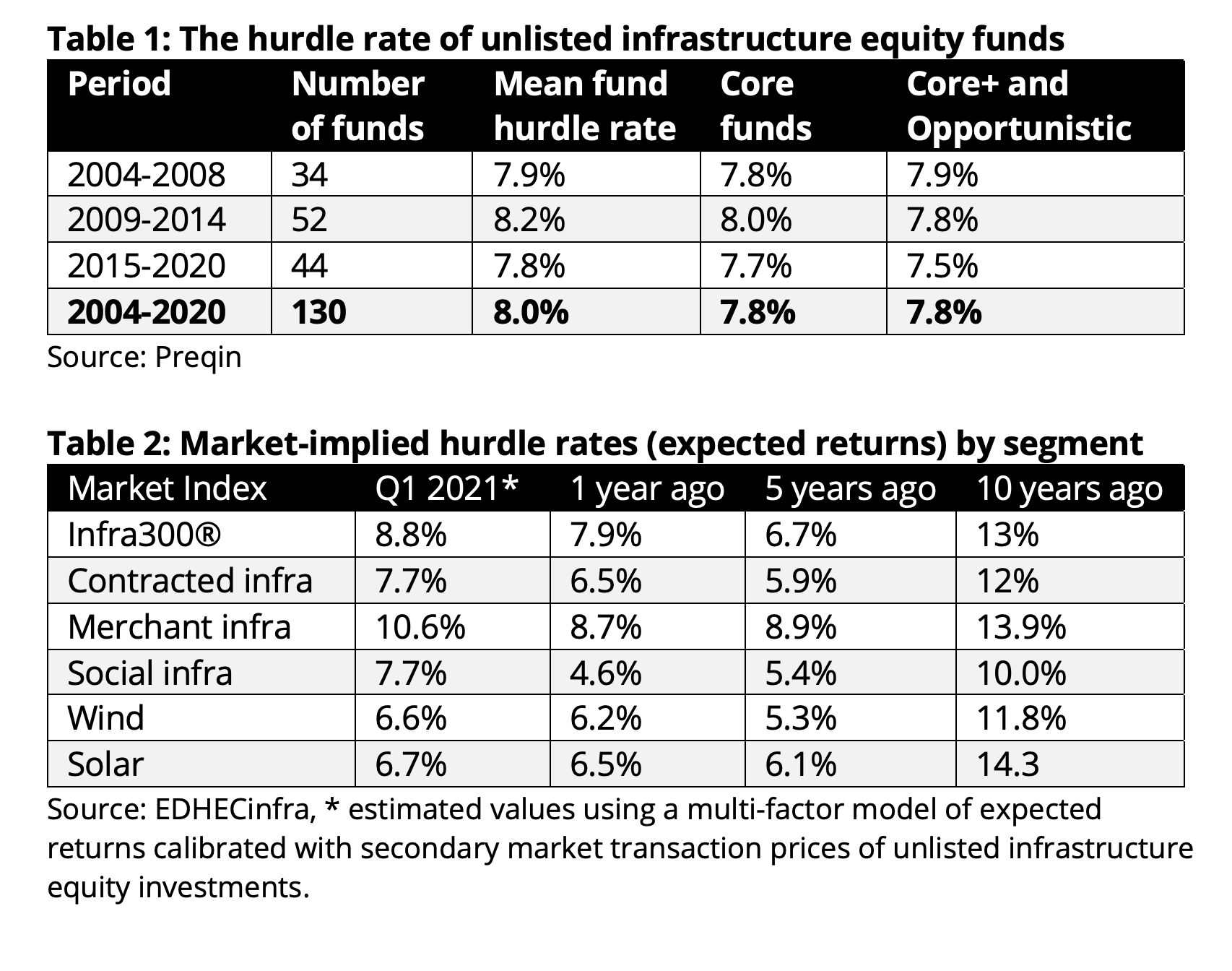

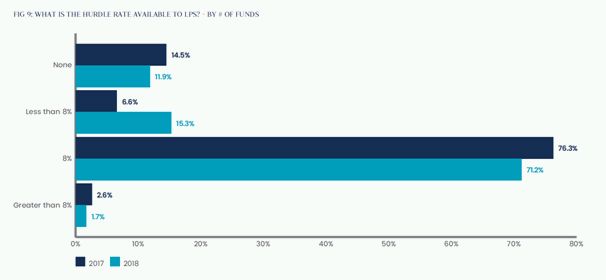

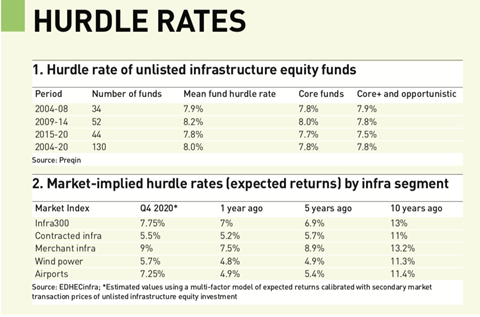

Hurdle rates typically favor projects or investments that have high rates of return on a percentage basis even if the dollar value is smaller. Most private equity funds set their hurdle rate or preferred return at around 8 though this may vary depending on the funds strategy. The rate is determined by assessing the cost of capital Unlevered Cost of Capital Unlevered cost of capital is the theoretical cost of a company financing itself for implementation of a capital project assuming no.

In infrastructure the private equity standard 8 percent still generally applies at the riskier value-add end of the spectrum but elsewhere on the risk-return spectrum the hurdle drops a notch or is predicated on. Ad See what you can research. To further complicate matters there are two types of waterfalls that could be used in a private equity transaction the European Waterfall and the American Waterfall.

For example project A has a return of 20 and a. Whether youre a business owner or planning for retirement understanding the hurdle rate can help you make better investment decisions. Get the most detailed and comprehensive private equity data.

Below this any returns on its investments will accrue only to. Assuming a Private equity fund is having a carried interest of 20 for the fund manager and a hurdle rate of 10. Ad Access vetted investments in exciting startups if your annual income exceeds 100k.

When a PE Fund realizes the profits then these profits shall be first allocated to the limited partner that is Investors. The European Waterfall In a European Waterfall structure 100 of property cash flow is paid to the LPs on a pro-rata basis until the preferred return hurdle is met and 100 of LP capital is returned. The terms hurdle rate and preferred return are often.

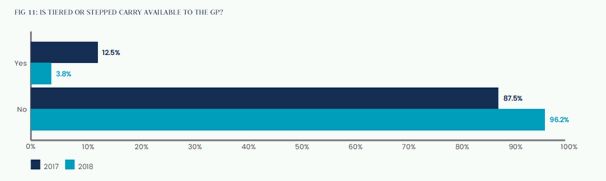

Get the most detailed and comprehensive private equity data. It is a step that a number of their private equity counterparts have already taken. Many managers it seems are rather keen to lower their hurdle rates the point at which lucrative catch-ups and performance fees kick in.

It is negotiated fund by fund and as such a low hurdle rate is viewed as vote of confidence by investors and worn like a badge of honour by a manager. A typical private equity fund has a hurdle rate usually a 7-8 return on its investment says Montgomery. Ad See what you can research.

If a 1 million fund has a 10 hurdle rate which would be very high it must return 11 million after one year or 2 to 26 million after 10 years depending on the compounding formula before the managers performance compensation kicks in. Find information on every aspect of the global PE ecosystem. OurCrowd provides an early investing opportunity to vetted tech startups alongside VCs.

Amid the latest round of Direct Lending fundraising a disturbing theme has started to emerge. Hurdle rates ranging from 6 to 8 annually are typical. This means the fund manager must generate an annualized net return of at least 8 for investors before the manager can share in any of the profits.

A hurdle rate is a yearly percentage return used to calculate the hurdle amount. The preferred return is usually expressed as a percentage return per year and in private equity that is usually 8 per year. In real estate there is no standard.

That specified return is usually called a hurdle rate or preferred return. Hurdle rate is the minimum acceptable rate of return for an investment.

Irr Internal Rate Of Return Definition Example Financial Calculators Cost Of Capital Balance Transfer Credit Cards

Private Equity Fees And Waterfalls On Direct Deals Family Capital

Private Equity Fees And Waterfalls On Direct Deals Family Capital

Private Equity Fund Terms Research Core Economic Terms Hurdle Rate And Carried Interest Corporate Commercial Law Uk

The Cost Of Not Paying Pmi Keeping Current Matters Private Mortgage Insurance Mortgage Payment Mortgage

This Visual Offers A Primer On Alternative Assets Hedge Funds And The Role That Shadow Accounting Plays In The Industr Fund Management Accounting Infographic

Corporate Venture Capital Venture Capital Corporate Venture Cvc

Why High Hurdle Rates Are Not In The Interest Of Investors In Infrastructure Funds

Private Equity Fund Terms Research Core Economic Terms Hurdle Rate And Carried Interest Corporate Commercial Law Uk

Litecoin Ltc Surges 20 Higher As Bitcoin Pushes To New Yearly Highs Bitcoin Ltc Cryptocurrency

Project Or Divisional Weighted Average Cost Of Capital Wacc Cost Of Capital Weighted Average Financial Strategies

Heres How To Use Finviz In 2018 To Find The Best Trade Ideas Day Trading For Dummies Investing Debt To Equity Ratio

Hurdle Rates A Ticking Timebomb Magazine Real Assets

Private Equity Fund Terms Research Core Economic Terms Hurdle Rate And Carried Interest Corporate Commercial Law Uk

Cost Of Equity Dividend Discount Model Dividend Dividend Investing Equity

Moats Neumann Disruptive Innovation Taxonomy Data Charts

European Battery Plant Expansion And Their Implied Lithium Demands Seeking Alpha The Expanse Battery Energy Storage

How Fixed Index Annuities Work Infographic Annuity Annuity Retirement Personal Financial Advisor

Lp Corner Fund Terms Carried Interest Preferred Return And Gp Catchup Allen Latta S Thoughts On Private Equity Etc

Post a Comment

Post a Comment