Hurdle rates offer a form of protection to LPs in the cases of weak to middling performance from a fund. 10 90 Hurdle 1.

Hurdle Rate Remains Elusive For Vc Funds Novo Resourcing Ltd

Some funds may also have a hurdle rate which is a rate of return that must be realized by the LPs before the GP will earn a carry.

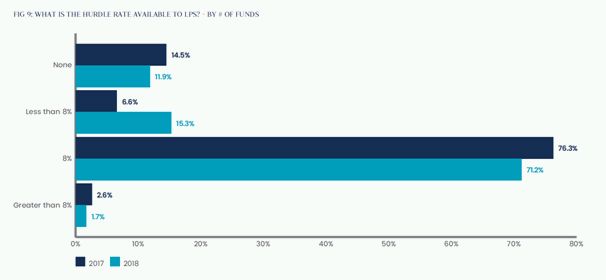

Hurdle rate vc. And whereas the median hurdle rate from 2018 was 8 its now 6. One might expect to see the adoption of more LP-friendly terms to help mitigate a tough fundraising climate. A senior leader at an emerging market institutional investor told me recently.

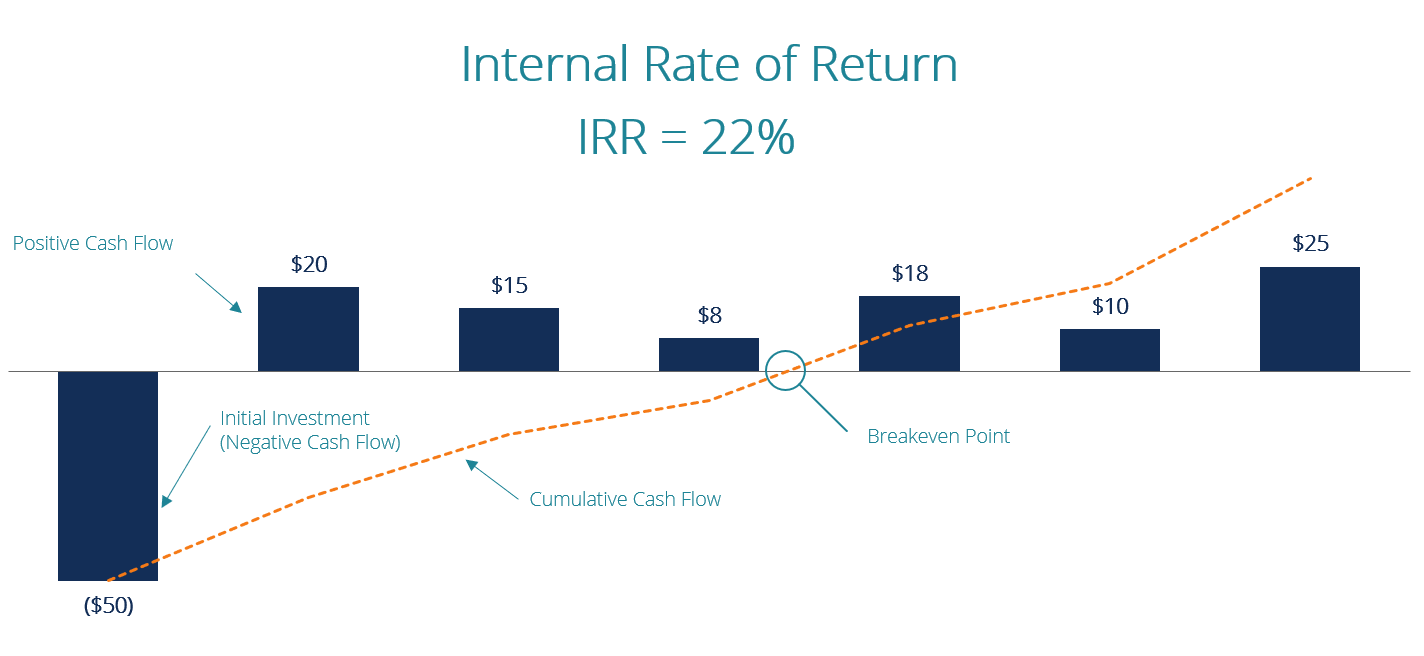

It might lead to shorter venture capital fund life spans. The preferred return is usually expressed as a percentage return per year and in private equity that is usually 8 per year. A hurdle rate which is also known as minimum acceptable rate of return MARR is the minimum required rate of return or target rate that investors are expecting to receive on an investment.

Its also important to be aware of the clawback a contractual provision that may be triggered when theres either a clerical error or otherwise that results in collecting too much carry. Hurdle rate vc DealBook Newsletter Bill Ackmans Deal Machine Must Try Again. The VC hurdle rate ie.

Managers who get paid on a deal-by-deal basis outperform those who are subject to hurdle rates according to new research. 20 80 Hurdle 2. Currently carry is treated as long-term capital gains and taxed at a rate of 0 percent 15 percent or 20 percentbased on the GPs income bracket.

A hurdle rate discourages risk taking. 8 before the GP. Most funds have a hurdle rate.

The Venture Capital Fee Structure That Produces the. Regulatory pressure forced his special purpose acquisition company to abandon a. Hurdle Carried Interest Preferred return.

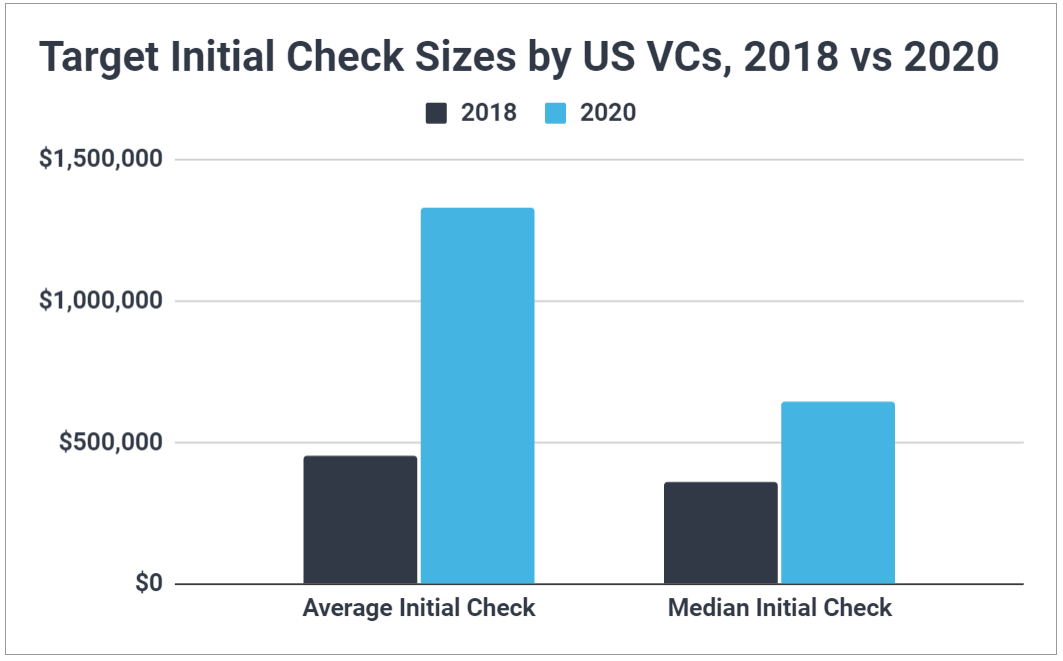

The arguments for an 8 preferred return hurdle for VC funds. A preferred return or hurdle rate is a minimum threshold return that LPs must receive before the GP can receive its carried interest or carry. Given the challenging fundraising climate in 2020 for most non-mega-sized VCs this comes as a bit of a surprise.

Unlevered Cost of Capital Unlevered cost of capital is the theoretical cost of a company financing itself for implementation of a capital project assuming no. Current models employing customary hurdle rates for sub-100 million emerging market PEVC funds create perverse incentives that misalign GPLP interests. Venture capital in this context means a fund that invests in early- to mid-stage technology companies software bio tech clean tech etc.

Because IRR is one of the main metrics to evaluate venture capital funds having a preferred return hurdle better aligns LP-GP interests. Better alignment of interests. Hurdle Rate R e p.

Only 38 percent of VC funds tracked over two decades produced gains exceeding the traditional 8 percent hurdle according to a statement Monday from the alternative-assets data provider. The rate is determined by assessing the cost of capital. The VCs required rate of return is then calculated by dividing the required return on equity calculated using CAPM for example by the probability of success.

An internal annual rate of return the VC firm must deliver to LPs before starting to receive any profit. The long held case is that VC funds take a lot of risk and investors want them to take a lot of risk. Hurdle rates are typically around 7-8 why.

So if the CAPM return on equity is 15 and the probability of success is 30 the VC hurdle rate is 50. Most venture capital firms do not have a hurdle rate. When I started managing our private equity portfolio a few years ago every fund was pitching 2 management fee and 20 carry with an 8 hurdle.

In other words the LPs must first receive all of their invested capital back plus an annual percentage return eg. It will make VCs focus more on the time value of money.

Chart Of The Week 8 Pct Remains Most Common Hurdle Rate Buyouts

7 Steps To Build Your Startup Business Video Start Up Business Startup Funding Start Up

5 Reasons Why You Should Take A Working Capital Loan Banking Venture Capital Instant Cash Loans

In Which Countries Do People Pay The Most Tax World Economic Forum Country The Only Way

Lp Corner Fund Terms Carried Interest Preferred Return And Gp Catchup Allen Latta S Thoughts On Private Equity Etc

Private Equity Fund Terms Research Core Economic Terms Hurdle Rate And Carried Interest Corporate Commercial Law Uk

Moats Neumann Disruptive Innovation Taxonomy Data Charts

7 Steps To Build Your Startup Business Video Start Up Business Startup Funding Start Up

Interview With Donald A Steinbrugge Cfa Managing Partner Agecroft Partners Interview Hedges Portfolio

Hurdle Rate Remains Elusive For Vc Funds Novo Resourcing Ltd

Internal Rate Of Return Irr A Guide For Financial Analysts

Vc Firms Being Disadvantaged By Traditional 8 Hurdle Rate Compared To Pe Altassets Private Equity News

Core Context Diagram Context Diagram Mission

Why Vc S Seek 10x Returns Nexit Ventures

Corporate Venture Capital Venture Capital Corporate Venture Cvc

4 Important Reason Why Startups Fail How To Stay Motivated Make A Person Start Up

Hurdle Rate Remains Elusive For Vc Funds Novo Resourcing Ltd

Corporate Venture Capital Venture Capital Corporate Venture Cvc

Post a Comment

Post a Comment